Client

Zerodha Varsity

Money Matters: Financial Literacy for Rural Women

Zerodha Varsity

Zerodha Varsity partnered with SVATAH: Education Foundation to implement a financial literacy program to rural women in Chikodi town of Belagavi district, Karnataka, through community partner Pankh India Foundation.

The engagement was documented and condensed into a glimpse to represent the need and intent behind the two day workshop for the fifty women from the community.

Category

Documentary Film

Client

Zerodha Varsity

Money Matters: Financial Literacy for Rural Women

Zerodha Varsity

Zerodha Varsity partnered with SVATAH: Education Foundation to implement a financial literacy program to rural women in Chikodi town of Belagavi district, Karnataka, through community partner Pankh India Foundation.

The engagement was documented and condensed into a glimpse to represent the need and intent behind the two day workshop for the fifty women from the community.

Category

Documentary Film

In her is a vast ocean

of infinite knowledge,

incalculable compassion.

Drops of sweat and tears

salvaged over generations,

unrequited yet divine.

The Hira sugar factory was a threshold of sorts which welcomed us into the town of Chikodi with its thick and intensely sweetened air reeking with pungency. We didn't expect the scale that we witnessed - at least a hundred bikes in the parking lot, followed by endless queues of double wagon tractors holding tonnes of sugarcane. The factory was a monstrosity of soaring metal structures and chimneys gleaming in the flood lights, set amidst cane dust suspended in the air. It was quite a surreal sight as we drove into the Chikodi, led by the smog that settled over the small town.

The next morning - a Sunday - urged us out of our rooms and into the sunny streets. We saw scores of tractors carrying people and tools across for day jobs perhaps to sugar factories, construction sites and agricultural fields. Every five minutes a gargantuan tractor would carefully slither past us with stacks of sugar cane neatly stacked heavily beyond its brim. We then reached our first destination - the humble home of Rupa who works for Pankh foundation. She had lost her alcoholic husband over six years ago and was left with three daughters to take care of. Being back in her mother’s house along with her brother’s family only made life more challenging for her. This exercise was our first step in understanding the need for financial literacy - an aspect that women self learn over time due to their circumstances.

On the first day of the workshop the group of fifty women were taught about the six pillars of financial literacy - earning, spending, saving, tracking/ budgeting, investing and borrowing. Chikodi in general and especially this group is multi religious - a large part of which is islamic and yet anything but shy or withdrawn as one from a city may expect it to be. Though it would not be careless to categorically state that discrimination is not present, seeing muslims and women as an integral part of the city’s fabric demolished our perception of what a small town “ought” to be. Yet, our limited interactions with some of these women revealed deep gender bias, addiction issues faced at home, financial and employment crises etc, that seem to make Chikodi no different as compared to any Indian city.

While the women were reserved in the beginning, they were also patient, perceptive and intelligent in their responses towards the end of the session. Egging them to mingle was only an initial need - they were quite comfortable with each other rather quickly - perhaps in solidarity due to the inherent domestic issues that are common to most households. Their lives were intertwined by similar challenges, which made it easier for the women to find comfort in opening up. There is no doubt that women are wired to multitask and are able to naturally maintain balance across various aspects of life. The goal of the workshop was simply to offer a framework and a disciplined method to organize their finances.

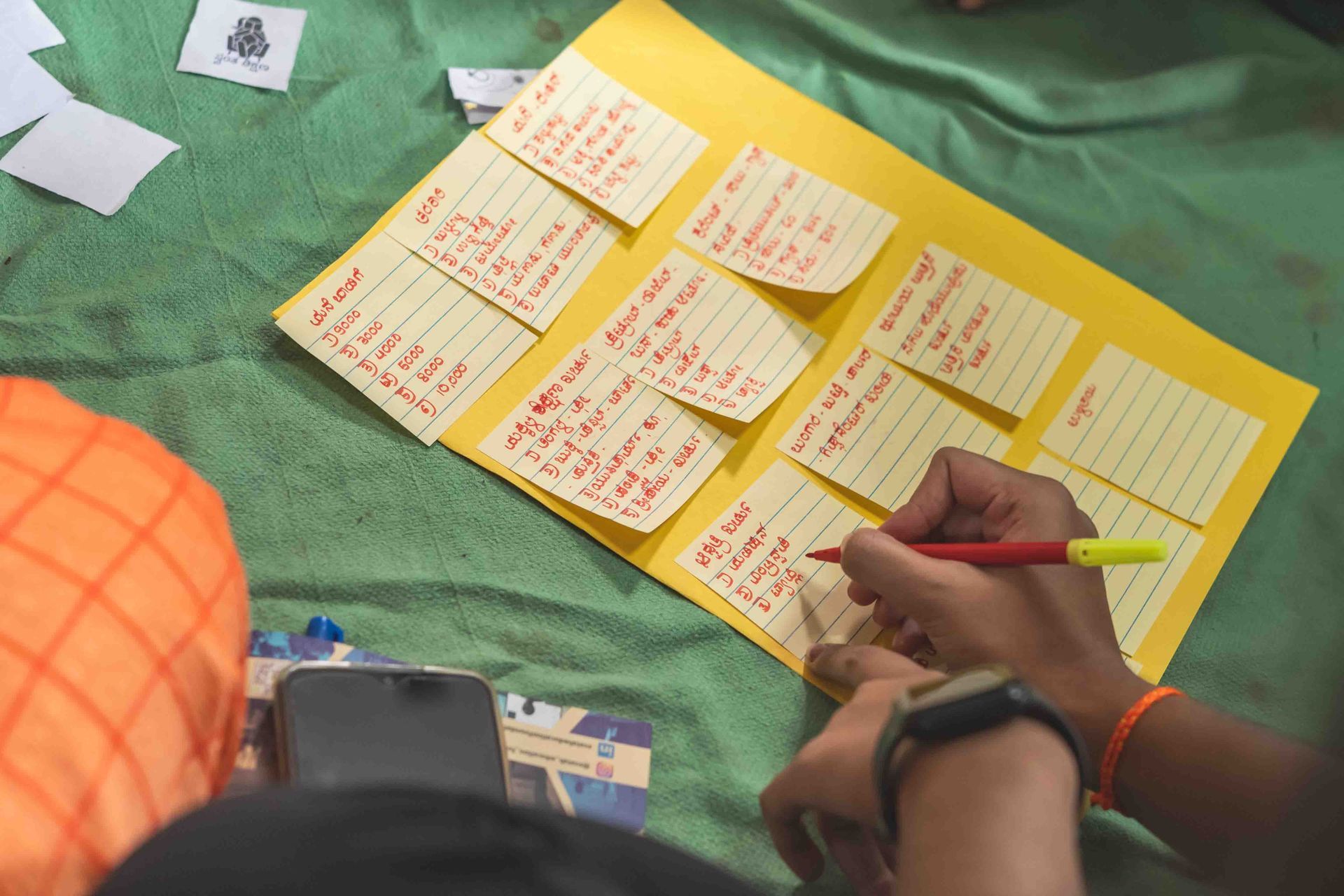

Svatah did this by introducing visually driven activities and a little help where basic calculations were involved. This approach resulted in open and uninhibited learning for all the fifty participants.

In an exercise where they were to list out their monthly expenditure, it was intriguing that none of the fifty women - not one - listed out alcohol, tobacco or other addictions among the expenses of the household. Not only is the concept of ‘categorisation’ new to them, but who would want to admit publicly to the demons that plague their homes? It is also possible that they do not consider these raving acts of consumption as worthy of any numerical objectivity. There were women who had taken matters into their own hands and those that had given in to patriarchal control. Some feel burdened by the need to cut down expenses while others do it effortlessly for the sake of their children. There were some commonalities in those who were able to overcome their own situations - optimism, self confidence and a never-waste-a-minute attitude. They had already been living a life guided by questioning how, rather than why.

Through the course of these exercises, women got more comfortable with enlisting expenses such as personal shopping, phone currency, parlor visits etc albeit with a snigger of guilt in their tone. It is a pity that a privileged group like us step in to call out their limited indulgences as anaavashyaka kharchu (needless expenses) so as to divert every possible penny towards savings or repayment towards loans taken by their husbands! The eventual goal with expense tracking is to be able to assess if they are needs, wants or vices - once again burdening women with the need to take action and give up on little things that they do for themselves. While an expense tracker may be a means to reaching their long term goals, it will only mean additional responsibilities in the short term. Such an engagement when viewed through a critical lens reveals its limitation to address the root causes of issues faced by women, and tend to focus on solution based approaches that only nurse generational wounds at a surface level.

It is also understandable that there is only so much that can be done in a defined time frame since even the beneficiaries need to see the value in stepping up - this is where grassroot organizations are vital in their involvement with the community for the long haul.

Having said that, there is no doubt that women - and even men - need to become empowered with the knowledge of finance.

One of the participants shared that she feels women need financial education more than men since they are the ones who splurge on shopping, while others felt it is needed since it is women who manage resources to run the household.

While self victimization is simpler to identify when viewed from a distance - one can genuinely hope that such sessions may make it more apparent to women themselves. While ‘empowerment’ seems like a far cry, even the knowledge and acceptance of one’s situation is a rare luxury in real life.

The founder of Svatah raised a valid point: many distressed women struggle through and overcome trying times of their own accord, by altering their attitudes and behaviors with the sole intention of turning their lives around. There is no doubt that this is neither easy nor simple without sacrifices both big and small. While we may view this from an external and sympathetic viewpoint, it is these very steps that can act as stepping stones for women to become independent of their husbands and financial aid or charity. So then why not make these proven methods and devices accessible for many more women to leverage for their own benefit? More than external support, it is empowered women that present themselves as inspiration for those in need, so they can help each other out in a sustained manner.

From the testimonials at the end of the second day, we started to really get to know these women. There was among the participants, a woman who had lost her husband early on and had yet built a life from scratch, now owner of acres of land; a woman who ran a parlor but spent carelessly; a woman who was independent and yet lacked the confidence to make financial decisions, hence heavily reliant on her husband; another woman who believed that there was no point in financial education when there is barely any money to manage - it is the husband who earns it and hence by default the one to decide what happens to it. But everyone unanimously felt that the workshop was beneficial to reinforce the discipline required, apart from introducing new ideas or means to them.

It was pointed out that women tend to always place others first, without ever featuring in their own personal dreams or goals. It was humbling to see this prove itself through the workshop when the group mindfully suggested that the program facilitator take a seat, since she was a young mother herself and had been on her feet for hours. There is also the irrational hierarchy and visible contrast in place with which city folk are generally viewed. Among the many takeaways, we were amazed at the discipline and perseverance exhibited by the women for their own time and that of the organizations that ‘had traveled all the way’ to impart knowledge. If anything, the workshop instilled in us a sense of gratitude at our own socioeconomic conditions, and strengthened our responsibility towards management of personal finance. We left with new definitions of empowerment, and with hope that the intelligence of these women would rub off on us ignorant city folk for years to come.

Produced by

Teepoi LLP

Commissioned by

Zerodha Varsity

Content, Direction

Karishma Rao

Cinematography

Vishwesh Shiva Prasad

Vinayak Bhat

Photography

Vishwesh Shiva Prasad

Karishma Rao

Money Matters: Financial Literacy for Rural Women

Zerodha Varsity

Zerodha Varsity partnered with SVATAH: Education Foundation to implement a financial literacy program to rural women in Chikodi town of Belagavi district, Karnataka, through community partner Pankh India Foundation.

The engagement was documented and condensed into a glimpse to represent the need and intent behind the two day workshop for the fifty women from the community. workplaces.

In her is a vast ocean

of infinite knowledge,

incalculable compassion.

Drops of sweat and tears

salvaged over generations,

unrequited yet divine.

The Hira sugar factory was a threshold of sorts which welcomed us into the town of Chikodi with its thick and intensely sweetened air reeking with pungency. We didn't expect the scale that we witnessed - at least a hundred bikes in the parking lot, followed by endless queues of double wagon tractors holding tonnes of sugarcane. The factory was a monstrosity of soaring metal structures and chimneys gleaming in the flood lights, set amidst cane dust suspended in the air. It was quite a surreal sight as we drove into the Chikodi, led by the smog that settled over the small town.

The next morning - a Sunday - urged us out of our rooms and into the sunny streets. We saw scores of tractors carrying people and tools across for day jobs perhaps to sugar factories, construction sites and agricultural fields. Every five minutes a gargantuan tractor would carefully slither past us with stacks of sugar cane neatly stacked heavily beyond its brim. We then reached our first destination - the humble home of Rupa who works for Pankh foundation. She had lost her alcoholic husband over six years ago and was left with three daughters to take care of. Being back in her mother’s house along with her brother’s family only made life more challenging for her. This exercise was our first step in understanding the need for financial literacy - an aspect that women self learn over time due to their circumstances.

On the first day of the workshop the group of fifty women were taught about the six pillars of financial literacy - earning, spending, saving, tracking/ budgeting, investing and borrowing. Chikodi in general and especially this group is multi religious - a large part of which is islamic and yet anything but shy or withdrawn as one from a city may expect it to be. Though it would not be careless to categorically state that discrimination is not present, seeing muslims and women as an integral part of the city’s fabric demolished our perception of what a small town “ought” to be. Yet, our limited interactions with some of these women revealed deep gender bias, addiction issues faced at home, financial and employment crises etc, that seem to make Chikodi no different as compared to any Indian city.

While the women were reserved in the beginning, they were also patient, perceptive and intelligent in their responses towards the end of the session. Egging them to mingle was only an initial need - they were quite comfortable with each other rather quickly - perhaps in solidarity due to the inherent domestic issues that are common to most households. Their lives were intertwined by similar challenges, which made it easier for the women to find comfort in opening up. There is no doubt that women are wired to multitask and are able to naturally maintain balance across various aspects of life. The goal of the workshop was simply to offer a framework and a disciplined method to organize their finances.

Svatah did this by introducing visually driven activities and a little help where basic calculations were involved. This approach resulted in open and uninhibited learning for all the fifty participants.

In an exercise where they were to list out their monthly expenditure, it was intriguing that none of the fifty women - not one - listed out alcohol, tobacco or other addictions among the expenses of the household. Not only is the concept of ‘categorisation’ new to them, but who would want to admit publicly to the demons that plague their homes? It is also possible that they do not consider these raving acts of consumption as worthy of any numerical objectivity. There were women who had taken matters into their own hands and those that had given in to patriarchal control. Some feel burdened by the need to cut down expenses while others do it effortlessly for the sake of their children. There were some commonalities in those who were able to overcome their own situations - optimism, self confidence and a never-waste-a-minute attitude. They had already been living a life guided by questioning how, rather than why.

Through the course of these exercises, women got more comfortable with enlisting expenses such as personal shopping, phone currency, parlor visits etc albeit with a snigger of guilt in their tone. It is a pity that a privileged group like us step in to call out their limited indulgences as anaavashyaka kharchu (needless expenses) so as to divert every possible penny towards savings or repayment towards loans taken by their husbands! The eventual goal with expense tracking is to be able to assess if they are needs, wants or vices - once again burdening women with the need to take action and give up on little things that they do for themselves. While an expense tracker may be a means to reaching their long term goals, it will only mean additional responsibilities in the short term. Such an engagement when viewed through a critical lens reveals its limitation to address the root causes of issues faced by women, and tend to focus on solution based approaches that only nurse generational wounds at a surface level.

It is also understandable that there is only so much that can be done in a defined time frame since even the beneficiaries need to see the value in stepping up - this is where grassroot organizations are vital in their involvement with the community for the long haul.

Having said that, there is no doubt that women - and even men - need to become empowered with the knowledge of finance.

One of the participants shared that she feels women need financial education more than men since they are the ones who splurge on shopping, while others felt it is needed since it is women who manage resources to run the household.

While self victimization is simpler to identify when viewed from a distance - one can genuinely hope that such sessions may make it more apparent to women themselves. While ‘empowerment’ seems like a far cry, even the knowledge and acceptance of one’s situation is a rare luxury in real life.

The founder of Svatah raised a valid point: many distressed women struggle through and overcome trying times of their own accord, by altering their attitudes and behaviors with the sole intention of turning their lives around. There is no doubt that this is neither easy nor simple without sacrifices both big and small. While we may view this from an external and sympathetic viewpoint, it is these very steps that can act as stepping stones for women to become independent of their husbands and financial aid or charity. So then why not make these proven methods and devices accessible for many more women to leverage for their own benefit? More than external support, it is empowered women that present themselves as inspiration for those in need, so they can help each other out in a sustained manner.

From the testimonials at the end of the second day, we started to really get to know these women. There was among the participants, a woman who had lost her husband early on and had yet built a life from scratch, now owner of acres of land; a woman who ran a parlor but spent carelessly; a woman who was independent and yet lacked the confidence to make financial decisions, hence heavily reliant on her husband; another woman who believed that there was no point in financial education when there is barely any money to manage - it is the husband who earns it and hence by default the one to decide what happens to it. But everyone unanimously felt that the workshop was beneficial to reinforce the discipline required, apart from introducing new ideas or means to them.

It was pointed out that women tend to always place others first, without ever featuring in their own personal dreams or goals. It was humbling to see this prove itself through the workshop when the group mindfully suggested that the program facilitator take a seat, since she was a young mother herself and had been on her feet for hours. There is also the irrational hierarchy and visible contrast in place with which city folk are generally viewed. Among the many takeaways, we were amazed at the discipline and perseverance exhibited by the women for their own time and that of the organizations that ‘had traveled all the way’ to impart knowledge. If anything, the workshop instilled in us a sense of gratitude at our own socioeconomic conditions, and strengthened our responsibility towards management of personal finance. We left with new definitions of empowerment, and with hope that the intelligence of these women would rub off on us ignorant city folk for years to come.

The shoot equipment needed to be kept away from both - extreme heat and the rains. Both lenses were to stay clear of the smoke - the camera and the eyes! Though devices and operators were to be shielded from head to toe, it was vital to prevent alienation from the workers, while also ensuring not to be an inconvenience at their place of work. The clockwork of churmuri making raised an awareness of the hard labour that is responsible for a single serving of mandakki that we ardently relish!

Produced by

Teepoi LLP

Commissioned by

Selco Foundation

Content, Direction

Karishma Rao

Cinematography

Vishwesh Shiva Prasad

Vinayak Bhat

Photography

Vandana Druva Kumar

Suchit Puri

An ode to the human machine,

the perceptive grain of rice,

the oblivious consumer,

and the ceaseless fire.